About Us

Executive Editor:Publishing house "Academy of Natural History"

Editorial Board:

Asgarov S. (Azerbaijan), Alakbarov M. (Azerbaijan), Aliev Z. (Azerbaijan), Babayev N. (Uzbekistan), Chiladze G. (Georgia), Datskovsky I. (Israel), Garbuz I. (Moldova), Gleizer S. (Germany), Ershina A. (Kazakhstan), Kobzev D. (Switzerland), Kohl O. (Germany), Ktshanyan M. (Armenia), Lande D. (Ukraine), Ledvanov M. (Russia), Makats V. (Ukraine), Miletic L. (Serbia), Moskovkin V. (Ukraine), Murzagaliyeva A. (Kazakhstan), Novikov A. (Ukraine), Rahimov R. (Uzbekistan), Romanchuk A. (Ukraine), Shamshiev B. (Kyrgyzstan), Usheva M. (Bulgaria), Vasileva M. (Bulgar).

Materials of the conference "EDUCATION AND SCIENCE WITHOUT BORDERS"

Attracting investments is the overriding term of economic development of every region. This is precisely why a special emphasis is put on creation of favorable conditions for investment for the regions. Investment attractiveness in these circumstances is considered as an integrated indicator of the most favored basis for an investor.

Taking into account the fact that any process management should be first of all based on objective assessment of its behavior characteristics, the necessity of its assessment is quite obvious.

As far as taking managerial decisions requires more than just stating the activities to be performed but requires achievement of the objectives set, the issue of assessment of investment attractiveness passes into the area of quantitative measurement of this indicator and outlining the main directions towards its improvement.

In the process of evaluation of the investment attractiveness there have been outlined the factors influencing its growth [1,2,3]. Finding and studying the effects of absolutely all factors is really hard and not always rational. The challenge is in determination of the most significant factors determinative of economy behavior. Numerical characteristic of particular aspects of the analyzed phenomenon and process is expressed through the system of indicators. Changes in meanings of the factors are defined by impacts of one or several indicators. That’s why the influences of some or other indicators on the investment attractiveness of economic and social systems are measured through the study of particular indicator group reflecting the effects of the given factors.

Based on the results of the analysis of different approaches to the assessment of investment attractiveness, there has been worked out and suggested the approach, based on the definition of economic and risk-related components of the regional investment attractiveness [1,2,3]:

1) Economic – covers the level of return of invest funds;

2) Risk-related – characterizes the overall risk connected with the considered economic and social system.

For the evaluation of the economic component of the investment attractiveness according to the System of National Accounts (SNA) at the regional level there can be used regional product as a set of economic sectors added value and taxes less subsidies on products – GRP.

When calculating the economic component of the regional investment attractiveness, Gross Regional Product (GRP) has to be reduced by the amounts of budgetary deficit, compensation of employees and taxes on production and imports.

Risk component is needed to determine the overall risk characterizing the given economic and social system. Risk component of the investment attractiveness is cumulative in nature because it formed from joint impact of different specific factors and can be given as follows:

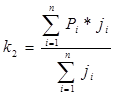

where k2 – risk component of investment attractiveness of the region;

n – number of factors;

Рi – characteristics of a factor;

ji – weighting coefficient of a factor.

The risk component helps to define what part of income will be lost as a result of its appearance. That’s why the composite indicator of the investment attractiveness of a region can be presented as follows:

К = k1 * (1 - k2)

where К – an economic and social system investment attractiveness factor, in unit fraction;

k1 – an economic component of investment attractiveness, in unit fraction;

k2 – a risk component of investment attractiveness, in unit fraction.

As far as the analyzed indicator of investment attractiveness by its nature presents the investment yield with risks taken into account, the obtained results can be used for the analysis of current condition of the regions, or for comparing the regions with one another. To have the opportunity not only to monitor but also control the volume of investment entering the regions it’s necessary to work out a formalized relation of the volume of investment and investment attractiveness factor.

When modeling the type of relation between the volume of investment and investment attractiveness, there have been used parameters [1,3,5,6,7]:

- Indicator of investment attractiveness of the region in the period t-1 (Кt-1);

- Volume of investments in the region in the period t-1 (It-1);

- Factor of disturbances (l), allowing to consider the averaged effect of human reasoning on economic functions.

The employment of forecasting approaches allowed to find that in general terms the model will look as follows [1,3]:

![]()

Based on the analysis conducted in terms of volumes of investment and factors of investment attractiveness over the past 36 years (from 1975 to 2011) there have been defined parameter values and each group of regions has its own parameters.

Methodology used for assessment of the investment attractiveness and worked out on its basis model allow to:

- To relate the received indicator values of the investment attractiveness to financial estimate of investors and regional growth supervisory authorities as this indicator characterizes profitability of investments with allowances made for probable losses;

- To employ the obtained results for the comparison of regions not only within Russian Federation but also out of its borders.

This gives the opportunity to fix the differences in the regions development, defining them and to work out the mechanism to impact these factors and trigger achieving the desired level at minimum cost. Thus the main difference and advantage of the suggested approach is not just the position of this or another region among other regions but also the employment of the received results of assessment for taking managerial decisions.

2. L.S. Valinurova Assessment of Conditions and Opportunities of Innovative Development of Regions [Text] / L.S. Valinurova // Economics and management: academic and research magazine– 2005 – N 3.

3. L.S. Valinurova Investment Activity Management: textbook. [Text] / L.S. Valinurova, O.B.Kazakova. –М.: KNORUS, 2005. –384 p.

4. L.S. Valinurova Basic Approaches to Reagional Investment Strategy Formation and Opportunities of Improvement [Text] / L.S. Valinurova // // Economics and management: academic and research magazine. – 2008. –- N1. –P. 45–53

5. L.S. Valinurova, O.B.Kazakova Development of Regional Growth Management Mechanism in Innovation-Driven Economy [Text] / L.S. Valinurova, O.B.Kazakova. – М.: Published «Paleotip», 2009. – 176 p.

6. L.S. Valinurova Rules and Patterns of Development of Innovation Processes in a Region [Text] / L.S. Valinurova // Innovations and Investments. – 2010. – N 3. –P. 12 –17..

7. L.S. Valinurova Efficient Management of Investment Processes in Innovation-Driven Economy: Tendencies, Preconditions, Concept [Text] /L.S. Valinurova // Economics and management: academic and research magazine. – 2013. –- N5.

Valinurova L.S. Effective Management of the Investment Processes at the Regional Level. International Journal Of Applied And Fundamental Research. – 2013. – № 2 –

URL: www.science-sd.com/455-24433 (24.02.2026).

PDF

PDF