About Us

Executive Editor:Publishing house "Academy of Natural History"

Editorial Board:

Asgarov S. (Azerbaijan), Alakbarov M. (Azerbaijan), Aliev Z. (Azerbaijan), Babayev N. (Uzbekistan), Chiladze G. (Georgia), Datskovsky I. (Israel), Garbuz I. (Moldova), Gleizer S. (Germany), Ershina A. (Kazakhstan), Kobzev D. (Switzerland), Kohl O. (Germany), Ktshanyan M. (Armenia), Lande D. (Ukraine), Ledvanov M. (Russia), Makats V. (Ukraine), Miletic L. (Serbia), Moskovkin V. (Ukraine), Murzagaliyeva A. (Kazakhstan), Novikov A. (Ukraine), Rahimov R. (Uzbekistan), Romanchuk A. (Ukraine), Shamshiev B. (Kyrgyzstan), Usheva M. (Bulgaria), Vasileva M. (Bulgar).

Investment in social projects isn't directed targeted at receiving extra profit, however, implementation of charity and social programs can lead to business-effect which, in turn, can bring benefit to primary activity of the company and therefore to increase profit.

Social investments are of particular importance for the companies in oil and gas sector of economy, as implementation of projects on mining is often accompanied by high risks, and the activity of the companies as such can have a negative impact on environment and local community.

To study positive business-effect emerging from investments in social programs, such investments should be considered as the projects which are carried out on a continuing basis, rather than as sporadic actions aimed at cushioning community’s perception company’s activity negative consequences. Such operating program actions, can lead to emergence of positive social effect.

One of the few companies realizing social projects and regularly publishing information in non-financial reports on the Internet, is JSC Lukoil, which served as an example for the researchers in the presented work. Namely, the authors considered the prospect of forecasting one of the main financial and economic indicators – business goodwill of the Company.

Goodwill – the indicator representing size of intangible assets of the company. As well as other intangible assets, this indicator is included in financial report, it appears in balance sheet and, as a result, is part of the company value.

The higher the Company’s business goodwill, the higher is its investment appeal, financial performance, the share price and capitalization. We are witnessing boost in confidence, the level of loyalty to the Company grows both in the region and in the whole country.

Studying interrelation of business goodwill indicator and corporate social investments, the first thing we are to do is to define existing functional aspect of this correspondence. This can be done through correlation and regression analysis [3-6].

What is particularly interesting, is not absolute values of social investments volume indexes, but rather influences of a share of the revenue spent on social investments, on business goodwill as this relative indicator is the most representative.

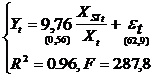

Applying least square method to estimate of coefficients, we receive the following model presenting influence of a share of social investments in total revenues of company on an indicator of business goodwill of the company

In this model ![]() – the volume of social investments,

– the volume of social investments,

![]() – revenue of the

company, R2 – coefficient of determination, F – Fisher statistic.

– revenue of the

company, R2 – coefficient of determination, F – Fisher statistic.

As may be inferred from results of estimates of standard deviations of coefficients, all coefficients of model are significant. Value of determination coefficient, is equal to 0,96 and allows to draw a conclusion that 96% of general dispersion of a characteristic of Y are explained by values of a share of the revenue spent on social investments, within the constructed model. The F-test at the chosen level of reliability of a=0,05 is passed. This shows that the developed model has high quality of the specification. To conclude it all, the model is adequate one and approximates basic data well. Besides, average error mean is equal to 8,9%, which proves good accuracy of model.

The analysis of model allows to draw a conclusion that the increase in a share of social investments in Company revenue by 1% increases indicator of business goodwill of JSC Lukoil by 9,76%.

Unlike investments into real sector of economy, influence of social investments on economic indicators of the company is not so obvious. Using real data, in this research we have built model allowing to perform quantitatively estimation of influence of social investments. The model can be used for forecasting size of business-effect, changes of main economic indicators values depending on change of social investments volume. This technique is universal and can be applied for assessing other companies.

2. Трегуб И.В. Финансирование инвестиционных проектов: классификация и оценка риска // Финансы. 2008. № 9. С. 71-72.

3. Трегуб И.В. Имитационное моделирование. - М.: Финансовая академия. 2007. 44 с.

4. Трегуб И.В. Методика прогнозирования показателей стохастических экономических систем // Вестник Московского государственного университета леса - Лесной вестник. 2008. № 2. С. 144-151.

5. Трегуб И.В. Особенности инвестирования в инновационные проекты // Экономика. Налоги. Право. 2013. № 3. С. 28-32.

Tregub I.V., Akhmetchina A. V. SOCIAL INVESTMENTS AND GODWILL. International Journal Of Applied And Fundamental Research. – 2014. – № 2 –

URL: www.science-sd.com/457-24711 (22.02.2026).

PDF

PDF