About Us

Executive Editor:Publishing house "Academy of Natural History"

Editorial Board:

Asgarov S. (Azerbaijan), Alakbarov M. (Azerbaijan), Aliev Z. (Azerbaijan), Babayev N. (Uzbekistan), Chiladze G. (Georgia), Datskovsky I. (Israel), Garbuz I. (Moldova), Gleizer S. (Germany), Ershina A. (Kazakhstan), Kobzev D. (Switzerland), Kohl O. (Germany), Ktshanyan M. (Armenia), Lande D. (Ukraine), Ledvanov M. (Russia), Makats V. (Ukraine), Miletic L. (Serbia), Moskovkin V. (Ukraine), Murzagaliyeva A. (Kazakhstan), Novikov A. (Ukraine), Rahimov R. (Uzbekistan), Romanchuk A. (Ukraine), Shamshiev B. (Kyrgyzstan), Usheva M. (Bulgaria), Vasileva M. (Bulgar).

Engineering

Meeting the challenges of constructing models of decision-making remains in the currently weak-formalized area in which the quality of the solutions essentially depends on the experience and intuition of researchers [3]. Currently, there are many different methods of decision making, suitable for solving problems, and at the same time there are practically no formal recommendations on the selection method for a given task. In this context, the aim of this research is to develope a mathematical model based on the Markov model of decision-making.

Businesses wishing to get a loan from the credit institutions (banks), as at the time of the loan may be in one of three states: state 1 - prosperous company, state 2 - the financial condition of the company is such that it is in the "5 years before bankruptcy " state 3 -" a year before the bankruptcy ". It is known from [1] that a company may be in any of this state, if at least three indicators pointing to Beaver belong to this state.

We assume that the decision maker (DM) from the lending institutions (banks) consider two possible options for action (strategy): ![]() - to give,

- to give, ![]() - not to give the company credit. We also assume that, depending on the state of the company

- not to give the company credit. We also assume that, depending on the state of the company ![]() ,

, ![]() , which is consistent, that its generated income can be calculated by the lending institutions (banks). For example, if at time

, which is consistent, that its generated income can be calculated by the lending institutions (banks). For example, if at time ![]() the company was in a state

the company was in a state ![]() and at time

and at time ![]() the state continues, it will be considered as the maximum income.

the state continues, it will be considered as the maximum income.

For example if ![]() thousnd rub, then the income matrix will be the limit as

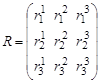

thousnd rub, then the income matrix will be the limit as ![]() , where

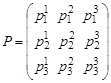

, where ![]() is the matrix elements of transition probabilities

is the matrix elements of transition probabilities ![]() .

.

Assume that we know the statistical (accounting) information of a company for three years ![]() . On the basis of these data, we calculate the coefficients

. On the basis of these data, we calculate the coefficients ![]() , from Beaver and probability [1]

, from Beaver and probability [1] ![]() , we have that the enterprise under investigationis is in

, we have that the enterprise under investigationis is in ![]() state at time

state at time ![]() ,

, ![]() . For illustrative purposes, the stitistical data for

. For illustrative purposes, the stitistical data for ![]() years was taken fro a particilar company OAO «Ленмолоко» [3]. The transition probability matrix is as follows

years was taken fro a particilar company OAO «Ленмолоко» [3]. The transition probability matrix is as follows ![]() :

:

; (1)

; (1)

Elements ![]() of the matrix denotes transition probability of the system in state

of the matrix denotes transition probability of the system in state ![]() . Thus the rows of the matrix correspond to the "state

. Thus the rows of the matrix correspond to the "state ![]() " and the colums - “time

" and the colums - “time ![]() ”. The sum of elements of each row is unity that is

”. The sum of elements of each row is unity that is ![]() ,

, ![]() .

.

For the simulation of the situation in the company, the transition probability matrix may be represented in the income matrix as follows: ![]() :

:

,

,

element ![]() of the matrix denotes the income obtained at time

of the matrix denotes the income obtained at time ![]() when the system is in state

when the system is in state ![]() .

.

With the matrix ![]() and

and ![]() one can simply predict the results of the system. In this case, the set of feasible solutions

one can simply predict the results of the system. In this case, the set of feasible solutions ![]() , where

, where ![]() - the decision to issue a loan the company, and

- the decision to issue a loan the company, and ![]() - not to issue. Thus, the transition probability matrix is given by [4,5]:

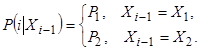

- not to issue. Thus, the transition probability matrix is given by [4,5]:

The transition of the company from one state to another is associated revenuematrix ![]() whose element

whose element ![]() is the income (positive values) for the

is the income (positive values) for the ![]() -th stage. At the same time, the income in

-th stage. At the same time, the income in ![]() -th stage is associated with the transition of the company from state

-th stage is associated with the transition of the company from state ![]() , in which it was after the

, in which it was after the ![]() -th stage, a state

-th stage, a state ![]() when deciding whether

when deciding whether ![]() .

.

Values [4,5] ![]() defines the expected revenue for the

defines the expected revenue for the ![]() -th stage, if after the

-th stage, if after the ![]() -th stage the company was able to be in

-th stage the company was able to be in ![]() state and it was decided to

state and it was decided to ![]() .

.

It is necessary to note that the decision-maker may be interested in the value of the expected income at a predetermined strategy of behavior in case of a state company ![]() . For example, PMD may consider that after

. For example, PMD may consider that after ![]() -th stage if the enterprise is in State

-th stage if the enterprise is in State ![]() , regardless of the particular value

, regardless of the particular value ![]() , it is necessary to make a decision

, it is necessary to make a decision ![]() .

.

For a finite planning horizon, ie, a finite number of steps ![]() of Markov decision problem with the principle of optimality, which is to maximize the expected revenue for the

of Markov decision problem with the principle of optimality, which is to maximize the expected revenue for the ![]() stages, it may be represented as a dynamic programming problem.

stages, it may be represented as a dynamic programming problem.

Let ![]() - expected optimal revenue ( that is optimality principle in its best use) for stages with numbers

- expected optimal revenue ( that is optimality principle in its best use) for stages with numbers ![]() , provided that after the

, provided that after the ![]() -th stage of the test, the company is able to be state

-th stage of the test, the company is able to be state ![]() ,

, ![]() . Since the planning horizon is finite, then the optimal expected revenue requirements must be satisfied

. Since the planning horizon is finite, then the optimal expected revenue requirements must be satisfied

![]() ,

, ![]()

Expected optimal revenue ![]() phases numbered

phases numbered ![]() consists of two component The first component - optimal revenue for

consists of two component The first component - optimal revenue for ![]() -m stage, due to a transition of the company from a state

-m stage, due to a transition of the company from a state ![]() in which it was at the

in which it was at the ![]() -th stage, in any admissible state,

-th stage, in any admissible state, ![]() [2,5].

[2,5]. ![]() ;

; ![]() (2), where

(2), where ![]() - the conditional probability that, after the

- the conditional probability that, after the ![]() -th stage the company will be in a state

-th stage the company will be in a state ![]() and has a feasible solution

and has a feasible solution ![]() ;

; ![]() - . income of the company in state

- . income of the company in state ![]() , in which it was after the

, in which it was after the ![]() -th stage as a result of

-th stage as a result of ![]() , from the set of feasible solutions

, from the set of feasible solutions ![]() . The second component of the optimal revenue

. The second component of the optimal revenue ![]() determined by a combination of optimal income

determined by a combination of optimal income ![]() ,

, ![]() , with transition probabilities

, with transition probabilities ![]() ,

, ![]() :

:

![]() .

.

We come to the recurrence equation of dynamic programming with a finite number of steps linking the expected optimal revenue ![]() ,

, ![]() и

и ![]() ,

, ![]() ,

, ![]() :

:

![]() ,

, ![]() ,

, ![]() .

.

In this case, we recall that ![]() ,

, ![]() и

и ![]() ,

, ![]()

Example: Assume that the lending institutions (Bank), considers the enterprise in question to provide credit. To do this, the bank needs to develop an optimal behavioral strategy, that is, to maximize the total return for the loan to the entity. Recall that the investigated company has identified three possible ![]() states: State 1 - prosperous company, state 2 - the financial condition of the company is such that it is in the "5 years before bankruptcy," state 3 - "a year before the bankruptcy." Set of feasible solutions

states: State 1 - prosperous company, state 2 - the financial condition of the company is such that it is in the "5 years before bankruptcy," state 3 - "a year before the bankruptcy." Set of feasible solutions ![]() , where

, where ![]() - the decision to issue a loan company, and

- the decision to issue a loan company, and ![]() - not to give. Transition probability matrix has the following form (see. (1)) [5].

- not to give. Transition probability matrix has the following form (see. (1)) [5].

This discourse was taken from a known statical (accounting) data on a gravity ![]() . On the basis of these data, we calculate the coefficients W. Beaver

. On the basis of these data, we calculate the coefficients W. Beaver ![]() and probability

and probability ![]() that the investigated the company is in

that the investigated the company is in ![]() state at time

state at time ![]() ,

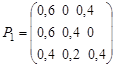

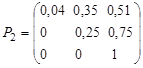

, ![]() , j = 1, 2, 3. Then, the transition probability matrix P1 is as follows:

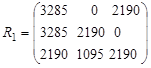

, j = 1, 2, 3. Then, the transition probability matrix P1 is as follows:  . The sum of elements in each row is unity, that is

. The sum of elements in each row is unity, that is ![]() ,

, ![]() .

.

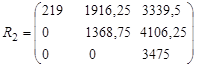

Suppose that on the basis of the resulting matrix of transition probabilities matrix ![]() is calculated as follows:

is calculated as follows: ![]() :

:  , and the income matrix

, and the income matrix ![]() in accordance with the transition probability matrix is calculated by the following formula

in accordance with the transition probability matrix is calculated by the following formula ![]() where

where ![]() th. rub. - desired income at time

th. rub. - desired income at time ![]() , and

, and ![]() - elements of the matrix of transition probabilities

- elements of the matrix of transition probabilities

;

;

We assume that the planning horizon is ![]() . From these matrices

. From these matrices ![]() ,

, ![]() ,

, ![]() ,

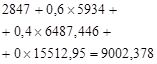

, ![]() , we calculate the expected revenues from the formula (2), due to the transition from one state to another in different variants of feasible solutions of the sets G of the companies considered:

, we calculate the expected revenues from the formula (2), due to the transition from one state to another in different variants of feasible solutions of the sets G of the companies considered:

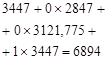

![]() ,

,

![]() ,

,

![]() ,

,

![]() ,

,

![]() ,

,

![]() .

.

For clarity, we use the tabular algorithm for solving this problem.

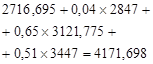

Table 1. Calculations of optimal expected revenue for the 1st stage of planning.

|

j |

|

Optimal expected revenue, |

Optimal decision |

|

|

|

|

|

||

|

1. |

2847 |

2716,695 |

2847 |

|

|

2. |

2847 |

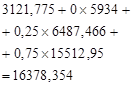

3121,775 |

3121,775 |

|

|

3. |

1971 |

3447 |

3447 |

|

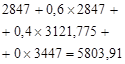

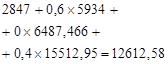

Table 2. Calculation of the optimal expected revenue for the second stage of planning.

|

j |

|

Optimal expected revenue, |

Optimal decision |

|

|

|

|

|

||

|

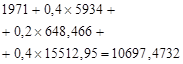

1. |

|

|

5934 |

|

|

2. |

|

|

6487,466 |

|

|

3. |

|

|

15512,95 |

|

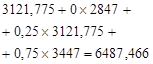

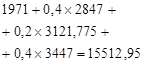

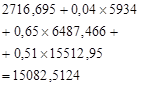

Table 3. Calculation of the optimal expected revenue for the third stage of planning.

|

j |

|

Optimal expected revenue, |

Optimal decision |

|

|

|

|

|

||

|

1. |

|

|

15082,5124 |

|

|

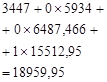

2. |

|

|

16378,354 |

|

|

3. |

|

|

18959,95 |

|

From the results, we conclude that the best solution for the three years (phase) is ![]() - not to give credit to the enterprise, regardless of the economic market situation. For all three years (stages) it is optimal to assume

- not to give credit to the enterprise, regardless of the economic market situation. For all three years (stages) it is optimal to assume ![]() as the feasible solution for all the possible states of the enterprise.

as the feasible solution for all the possible states of the enterprise.

2. Nedelko V.M. Some questions evaluating the quality methods for constructing decision functions // Bulletin. that. state. Univ. management, computer sc.& inf.. 2013. №3 (24). p.123-132.

3. The financial statements of the enterprise O.A.O. "Lenmoloko" (2013): [electronic resource] // - Mode of access: URL: http://www.len-moloko.spb.ru/documents/balance.html/.

4. Volkov, I. K., Zagoruiko E. A. operations Research: Textbook / Ed. by C. S. Zarubin, A. P. Grishenko. - M.: Izd-vo MGTU im. N. E. Bauman, 2000. - 436 S.

5. Chernorutskii I. G., Methods of decision-making. - SPb.: BHV-Petersburg, 2005. -416

Bamadio B.., Marina K.V., Konstantin L.A. ON A DECISION MODEL TO GRANT LOANS TO ENTERPRISES ON THE BASIS OF MARKOV MODELS FOR FINITE HORIZON.. International Journal Of Applied And Fundamental Research. – 2015. – № 1 –

URL: www.science-sd.com/460-24750 (04.03.2026).

PDF

PDF