About Us

Executive Editor:Publishing house "Academy of Natural History"

Editorial Board:

Asgarov S. (Azerbaijan), Alakbarov M. (Azerbaijan), Aliev Z. (Azerbaijan), Babayev N. (Uzbekistan), Chiladze G. (Georgia), Datskovsky I. (Israel), Garbuz I. (Moldova), Gleizer S. (Germany), Ershina A. (Kazakhstan), Kobzev D. (Switzerland), Kohl O. (Germany), Ktshanyan M. (Armenia), Lande D. (Ukraine), Ledvanov M. (Russia), Makats V. (Ukraine), Miletic L. (Serbia), Moskovkin V. (Ukraine), Murzagaliyeva A. (Kazakhstan), Novikov A. (Ukraine), Rahimov R. (Uzbekistan), Romanchuk A. (Ukraine), Shamshiev B. (Kyrgyzstan), Usheva M. (Bulgaria), Vasileva M. (Bulgar).

Agricultural sciences

For risk assessment entre-neurial activities, future economic benefits, as well as the development prospects of the companies reporting in addition to the users of the information contained in the forms of financial statements (balance sheet, income statement, and others.), Must be differentiated data disclosing financial results for its individual directions. This task contributes to the organization of segmental accounting not only for operational but also by geographical segments. For this purpose, the methodology of management accounting model is proposed to add to the cost accounting system of hierarchical management of industrial enterprise (Model II).

Important methodological aspect is that the basis of the proposed model is based on a synthetic account of the cost of production. Foreign experience of formation and use of management accounting systems for this purpose indicates that develop and complicate the system must be gradually introducing her special accounts management accounting. Account management accounting to the extent separated from the accounts of financial accounting that each group is summarized them as a separate administrative system, not related to any other general accounting entries.

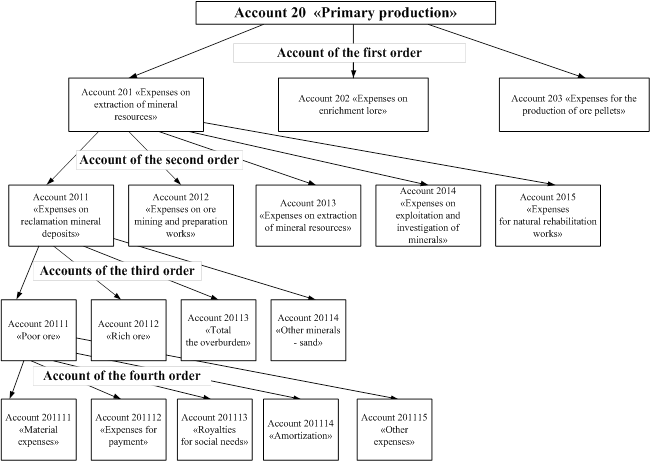

Implementation and testing of the proposed method of cost accounting and calculation of cost of production carried out on materials extractive mining enterprise JSC «Mikhailovsky ore processing plant» Zheleznogorsk Kursk region. In particular, the system of management accounting costs of «GOK» is proposed to organize accounts subcontracting submission. Detailed information about costs in the accounts of synthetic accounting will be linked with the group costs proposed in the model (I) (Figure 1).

Figure 1 - Detailed information on the accounts of managerial cost accounting

The proposed method subcontracting submission is closely linked with technological and production characteristics of industrial enterprises. Due to the nature of its activities, the company may be limited to three levels of sub-accounts that are opened to the expenditure accounts, or, conversely, to expand them to five, six levels, etc. This fact underscores the versatility of the proposed methodology and allows the use of its enterprises in various spheres of industrial production. The result of a submission technique of subcontracting in relation to synthetic accounts is appearing at the enterprise possibility of a segmental reporting, basic forms of which are presented in Table 1.

Table 1. Forms of segmental reporting

|

Name of segmental reporting

|

Source formation in the model (I) |

Source formation in the model (II) |

|

1 |

2 |

3 |

|

1. Report on production costs by type of activity centers of responsibility

|

Statement of calculating the cost of manufacture of rich ore, Statement of calculating the cost of manufacture low-grade ore, Statement of calculating the cost of manufacture of other minerals |

Information collected on the cost accounts of the first level of subordination subcontracting various responsibility centers |

|

2. A report on the costs of production for technological stages of the production process of responsibility centers |

Statement of cost accounting for technological stages of the production process at the center of responsibility |

Information collected on the cost accounts of the second level of subordination subcontracting various responsibility centers |

|

3. A report on the costs of production by product and semi-finished products of responsibility centers |

Statement of calculating the cost of manufacture of rich ore, Statement of calculating the cost of manufacture low-grade ore, Statement of calculating the cost of manufacture of other minerals |

Information collected on the cost accounts of the third level of subordination subcontracting various responsibility centers |

|

4. Report on the cost of 1 ton of products and semi-finished products

|

Statement of calculating the cost of 1 ton of high-grade ore, Statement of calculating the cost of 1 ton of low-grade ore, Statement of calculation of the cost of 1 ton of other minerals |

- |

|

5. A report on the costs of production by product and semi-finished products in the context of cost elements

|

- |

Information collected on the cost accounts of the fourth level of subordination subcontracting various responsibility centers |

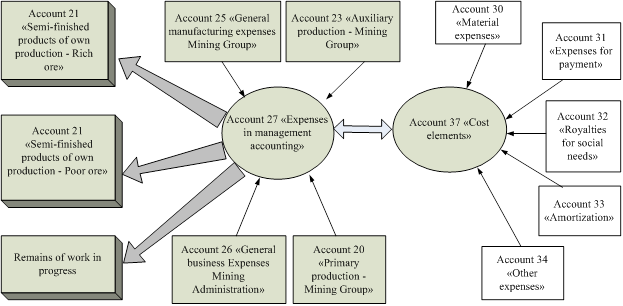

By taking into account the cost of production should be supplemented by a reflective account 27 «Еxpenses in management accounting»; to mirror the information generated in financial accounting on account 37 «Сost elements» (Figure 2). The balance of the balance of the management accounting (accounts 20-29) provides a technique of all entries in the accounts through their reflection on the loan (or, as appropriate, - debit) through 27 «Еxpenses in management accounting». It is proposed to constitute a separate balance sheet accounts management accounting, which allows you to close the confidential information on the costs detailed in the accounts management accounting.

Figure 2 - Scheme of the accounting records of the account 27 «Еxpenses in management accounting» in the division Mining Group JSC «Mikhailovsky GOK»

The proposed model of cost accounting in the system of hierarchical control allows to make a report on the financial results in two formats provided by IFRS 1: in nature (types of) cost and cost function cost (Traditional version) (Table 2).

Table 2. Detail of the profit and loss account by type (nature of expense)

|

Indicators |

Expense |

Calculation procedure |

|

1 |

2 |

3 |

|

Material costs

|

30 |

Debit 37 «Reflection of the cost of the elements» Credit 30 «Material costs» |

|

Labor costs

|

31 |

Debit 37 «Reflection of the cost of the elements» Credit 31 «Labor costs» |

|

Fringe benefit expenses

|

32 |

Debit 37 «Reflection of the cost of the elements» Credit 32 «Fringe benefit expenses» |

|

Amortization

|

33 |

Debit 37 «Reflection of the cost of the elements» Credit 33 «Amortization» |

|

Other expenses

|

34 |

Debit 37 «Reflection of the cost of the elements» Credit 34 «Other expenses» |

|

Total expenses from ordinary activities

|

37 |

å expenses = turnover account 30 + turnover account 31+ turnover account 32 + turnover account 33 + turnover account 34 |

The proposed cost model in the hierarchical control is methodical and organizational separation of accounts management accounting, as they are created in-house confidential information to management. Proposed for this purpose the system of accounts to determine the direction of the company's accounting policies, generate information for users of different hierarchical levels.

The advantage of the proposed techniques is their flexibility and versatility. Thus, by introducing additional components or excluding certain items, an enterprise of any industrial production has the ability to time-operate its own method of cost accounting that meets the interests of internal and external users.

Ilyukhina N.A. MODEL OF COST ACCOUNTING IN THE HIERARCHICAL MANAGEMENT OF INDUSTRIAL ENTERPRISE. International Journal Of Applied And Fundamental Research. – 2015. – № 1 –

URL: www.science-sd.com/460-24764 (04.03.2026).

PDF

PDF