About Us

Executive Editor:Publishing house "Academy of Natural History"

Editorial Board:

Asgarov S. (Azerbaijan), Alakbarov M. (Azerbaijan), Aliev Z. (Azerbaijan), Babayev N. (Uzbekistan), Chiladze G. (Georgia), Datskovsky I. (Israel), Garbuz I. (Moldova), Gleizer S. (Germany), Ershina A. (Kazakhstan), Kobzev D. (Switzerland), Kohl O. (Germany), Ktshanyan M. (Armenia), Lande D. (Ukraine), Ledvanov M. (Russia), Makats V. (Ukraine), Miletic L. (Serbia), Moskovkin V. (Ukraine), Murzagaliyeva A. (Kazakhstan), Novikov A. (Ukraine), Rahimov R. (Uzbekistan), Romanchuk A. (Ukraine), Shamshiev B. (Kyrgyzstan), Usheva M. (Bulgaria), Vasileva M. (Bulgar).

Economics

The domestic investment construction sphere in the regional and sectoral projections is represented as a “regional investment construction complex (IBC)”. In the scientific school “Methodological issues of efficiency of regional investment construction complexes as a self-organizing and self-regulating system” at Saint-Petersburg State University of Architecture and Civil Engineering (SPSUACE) the investment construction complex is considered as a set of business entities, institutions involved in the processes of investment, construction, maintenance and consumption of a real estate item connected by the common technological or economical risks” [1,2,3,4]. The perspective of the scientific school assumes the regional nature of IBC2 that determines its understanding as a localized territorial system. That is, management of a cycle of construction (reconstruction) of a local in a territorial plan of a real estate item is realized by the whole of subjects of the respective region. Investment, innovative and industrial potential of subjects is regarded as a regional IBC’s resource. In this context, the investment construction sphere can be regarded as a regional meso-level system, studied in this work as “innovation system”. Like any other system it is studied through the whole of subjects and their interactions (relations). Accordingly, formalization of a scientific basis set forth in this work assumes the solution of the following issues:

1) emphasizing of the subjects of a regional IBC and consideration of areas of their innovative activities;

2) formalization of stages of an investment construction cycle as an integrator of innovative linkages of a regional IBC;

3) description of a dynamic structure of an investment construction cycle;

4) determination of the economic orientation effects after implementation of innovations into the investment construction cycle. Solution of the set tasks determines a regional IBC as an innovation system – the whole of subjects, which perform innovative activities in the framework of investment construction cycle. Consolidation of different views on the nature of IBC allowed separate 16 participants of an investment construction activities [5,6] (table 1). And in the context of the work [7] there were studied the main areas of innovative activities of the considered subjects (“Direction of…”, table 1). As a basis of the research there was laid the experts interrogation regarding “the most distinctive innovative solutions offered by organizations of a regional IBC”. The expert interrogation was performed according to the «Delphi» method, the level of consistency of answers was assessed by the value of dispersion. The obtained answers of experts were interpreted by us as wording, containing information concerning orientation of innovations of subjects and the expected effect from realization of the new solution. Thus, let us describe (table 1) the structures of a regional innovation and construction system: subjects of investment construction activity and focus of their innovative capacity.

Subjects of investment construction complex and focus of their innovative activities.

|

Subject of IBC

|

Direction of innovative activities

|

|

Public authorities

|

Reduction of transaction costs of subjects of investment construction complex by reducing the duration of normative-regulatory procedures.

|

|

Turnkey contractors

|

Reduction of duration of construction and installation works by means of organizational innovations in the controlling and coordination systems.

|

|

Construction and installation organizations (subcontractors) |

Reduction of labor intensity, increasing performance of construction and installation works. |

|

Investors

|

Models of financial and investment management, risk assessment of investment construction projects |

|

Scientific research centers

|

Development of fundamental scientific-research principles of organization of construction process, using materials and designs. |

|

Educational facilities

|

Improving methods of preparation (training) and retraining of specialists. |

|

Design institutes and bureau

|

Methods of designing, visualization of architectural and construction objects, infrastructure of land parcels. |

|

Regional engineering facilities and prospectors

|

Methods to increase the accuracy of survey and engineering solutions, aimed at reduction of duration of construction and installation works.

|

|

Realtors

|

New methods of marketing and distribution of construction facilities.

|

|

Shipping companies

|

Reduction of term and increasing the accuracy of delivery of construction materials.

|

|

Manufacturers of materials

|

Construction materials and structures with improved technical and/or performance characteristics and competitive price.

|

|

Lessors of construction machinery and equipment

|

Machinery and equipment with improved performance and/or lower cost of maintenance, lease.

|

|

Registrars of rights

|

Methods and algorithms of analysis of documents aimed at reduction term of service of a single package.

|

|

Operators of real estate property management

|

Real estate management processes aimed at reduction of maintenance cost of a facility.

|

|

Insurance companies

|

Methods of assessment and sharing of risks of investment and construction processes ensuring reduction of percentage rate.

|

|

Self-regulatory organizations (SRO), industry associations

|

Methods of risks and liabilities diversification within a regional investment construction complex. |

Direction of innovative activities of subjects of a regional IBC is a very diverse: from the new building materials up to the methods of financing construction and organization of processes of passing of permits. It is important to understand, that all of the institutional entities of a regional IBC (a consequence of data, table. 1) are able to offer innovative solutions, that is, they have an innovative potential. But the entities can realize their innovative potential only in cooperation due to contractual relationships in the process of construction (reconstruction) of an object. An investment project of construction facility is a basis for contractual interaction. Economy and logic (the sequence and function) of interaction of entities concerning the project is academically described in the framework of investment construction cycle (hereinafter – ICC). It is quite concordantly in the scientific literature [8,9,10] understood as the whole of stages and works from the investment idea to decommissioning of a real estate facility. By decommissioning, we mean the end of economic interactions of the parts of investment construction activity concerning a real estate facility. In the foreign science and practice their decommissioning is regarded [11] as a disposal of a facility – breakup, waste disposal and release of a site. However, the domestic scientists hold the position of loss of “functionality for the beneficiary” [8]. That is to say, that within the designated logical boundaries of an investment construction cycle the potential of a regional innovation system is implemented.

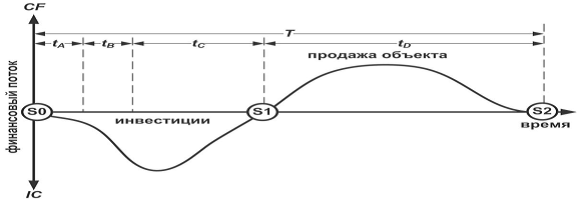

The key principle of study of innovative activity in a regional IBC is availability of cross (multiplicative) effects of an innovative activity on the stages of ICC: effect of innovations implementation is revealed in the subsequent stages. For example, the economic benefits of energy saving technologies in construction may occur only in the maintenance phase, when the user of a real estate facility will be able to reduce his costs for heating and lighting of a facility. Alternatively, innovative methods of design and survey works will show up in reduction of duration of a building phase. “…The objective contradiction, which arises in the various stages of construction. Innovations often presuppose high costs in the phase of project development and construction and getting benefits from operation in the future…” [12]. Approving of the above-mentioned principle presupposes that innovative potential of IBC emerges within ICC as an integral process. Consequently, the hypothesis of scientific research takes the following form: economic effects of realization of innovative potential of a regional IBC emerge and may be assessed only within a full life cycle of a real estate facility (from the investment idea to the decommissioning). Accordingly, formalized stages and operations of investment construction cycle become the key platform of research. Practice of implementation of investment construction projects quite objectively emphasizes 4 stages: pre-investment, design and survey, construction, operation. Emphasizing of stages is built on separation of: functionality of a construction facility (under construction, in operation); transforming of a capital (intention, investment, return); managers (investor, project developer, turnkey contractor). Analysis and generalization of publications [13,14], studying contractual [5] and transaction [4] models of organization of an investment construction process let the author formalize the primary operations and their results summarized in the table 2. Operations are executed by entities of a regional IBC and interrelated through contractual relations in the form of contracts. Namely within the contract there may be put innovative solutions affecting the economic efficiency of separate stages or the whole project. Every cycle operation is specified and formalized by content and result (table 2). It allows link the «owners» of the operation, direction of their innovative activity (table 1) with integral process targets of the investment construction cycle, implementation potential of innovations within the stages [15,16]. We call your attention to the fact that the obtained phase-by-phase, maintenance vision of ICC corresponds to the declared definition and can be considered as an intermediate scientific result: actualization and refinement of concepts of construction economy concerning the structure of investment construction cycle. Formalized ICC (table 2) is represented in a process form, which is the basis for description of its dynamic structure, which allows link innovation effects with economical result of the cycle. Dynamic models of investment construction projects are very diverse [17,18,19], their variability is stipulated by the type of a facility (residential, commercial, industrial etc.), sources of investments, maintenance objectives and conditions, other sectoral and regional factors. That’s why this work offers a universal, reduced by variation parameters model of dynamic structure of a cycle, built on the set boundary conditions and assumptions. The graphic form of the model is shown in the Fig. 1, and assumptions are formulated through the following provisions:

1. Results of innovative activities in the framework of ICC are taken into account at the level of financial results of an investor. Effects of innovation activities of individual participants of a process are taken into account only when they are shown up in a cycle. If a participant of a cycle creates innovation, but its result doesn’t affect economic parameters of the subsequent (“alien”) operations or the whole cycle, then the innovation is not considered. For example (1), a project developer introduced new methods of developing allowing reduce the cost of project developing for the investor. As a result, he wins the tender, but the investor (turnkey contractor) gets from him a product without change of quality and (essential) cost parameters. In such a situation, the innovation is recognized as a local one, not rendering the set principle – cross-effects in the stages of ICC. For example (2), the project developer won the tender, but according to results of implementing the innovation he reduced the period of his own works. It significantly affected the duration of the whole investment construction cycle. The situation is recognized as innovative, because it is consistent with the principle of cross-effect.

2. Innovations should influence the financial indicators of an investment project, because it is investor who takes decisions concerning including specific results of R&D into the cycle. Accordingly, as the base indicator of the investor’s productivity there is taken the net present value – NPV, and as an indicator of efficiency of investments – internal (modified) rate of return.

3. Cash flow from the position of ICC is divided into an investment – negative and maintenance – positive. The economic result of a cycle is academically considered as a balance of negative (S0-S1, Fig. 1) and positive (S1-S2) cash flow. Return of the invested equity (S1-S2) from a real estate facility occurs only at the maintenance phase. In case of using the scheme of investee, the funds invested before the operation are considered as investments (i.e., within S1, Fig. 1). The reasoning of this provision is built on objectivity lower in regard to the market (located on the exposition at the time of investment) price per a single area of a facility.

4. Assumption: dynamics and the structure of repayment of money in the maintenance period have no variation by the type of built (reconstructed) real estate facility. It is assumed, that the investor transfers the propriety of the built facility in the maintenance period on a reimbursable basis. Investor does not retain any rights of ownership neither to commercial, nor to residual, nor to industrial facility.

Stages of an investment construction cycle.

|

Stages and cycles

|

Content of operations

|

Results of operations

|

|

|

Phase A. Pre-investment

|

|

|

Choosing investment intentions

|

Elaboration of an investment idea, marketing and functional concept of a facility-site. Choosing schemas of the investment project financing

|

Investment (business) plan.

|

|

Pre-project preparation

|

Rationale for the construction and getting permits. Selection and allocation of land for construction, including approvals; obtaining “Architectural and Planning Assignment”.

|

Preparation of set of documents of a project: “justification of investments”, selection of a construction site, architectural and planning assignment.

|

|

|

Phase B. Planning and Surveying

|

|

|

Engineering surveys

|

The study of characteristics and natural conditions at the construction site. It includes engineering-geodesic, geotechnical, engineering and hydrometeorological, engineering-environmental and surveying of ground construction materials and underground water sources.

|

Reports for each type of survey regulated by SNiP 11-02-96.

|

|

Project development

|

Development of design estimates of construction (reconstruction) of a facility, land parcel. In the most complete form it includes a number of works related to preparation of a master plan, ameliorative part, agricultural building and land development, project of construction organization, description of natural conditions, civil defense and emergencies measures and the economic part. Execution of technical specifications for connection to external engineering networks. |

Technical specifications for a project development, project and expert opinion, approval of a project and set of working documents (SNiP 11-01-95).

|

|

|

Phase С. Construction

|

|

|

Construction and installation works |

Selection of a turnkey contractor and entering into a contract, including tender procedures on selection of contractors, sub-contractors, suppliers. Process of organization and performing of construction and installation works, including engineering supervision, control of quality and terms of execution of works. Budgetary control. Pre-commissioning activities at start-up of industrial facilities. Facility commissioning.

|

Commissioned construction facility.

|

|

|

Phase D. Maintenance

|

|

|

Maintenance of a facility

|

Implementation of the project’s results, registration of rights. Sale of the facility (leasing). Process of maintenance of a facility in the framework of the specified functionality and maintaining its technical condition (including utility infrastructure).

|

Getting income from operation of a facility, return of investments.

|

As a matter of principle, such an assumption is quite justified by the practice of investment construction activities. For example, the full implementation of a residual real estate facility at the moment of its commissioning. Or construction and sale of commercial or industrial facility straightforwardly at the moment of commissioning. Business practices of the construction industry increasingly divide a developer and real estate owner as different institutional parts. Assuming, that the second enjoys benefits from maintenance of a facility, and the first – only from investments and construction process. That is, investment construction cycle ends with a transfer of property rights by investor. Its owner is a beneficiary from maintenance of a facility (S1-S2). In the framework of the stated conditions and limitations of a model of investment construction cycle its dynamic structure may be described as a balance of positive and negative cash flows in the framework of planned duration of investments allocation (Т, Fig. 1).

Финансовый поток – cash flow, инвестиции – investments, продажа объекта – sale of a facility, время – time. Fig. 1. Dynamic structure of an investment construction cycle (legend in the context of a paragraph).

Actually, it is an academical way of designation of a target parameter of financial solvency (assumption 2) of an investment construction cycle – net present value of an investor. Counting as a constant the planned duration of an investment construction cycle (T) it can be set as a sum

of four stages (table 2): ![]() , (1.1) where tA – duration of pre-investment phase;

, (1.1) where tA – duration of pre-investment phase;

tB – duration of development-survey phase; tC – duration of construction phase;

tD – duration of maintenance phase.

Three stages are located in the area of negative cash flow . are investments grantors, and one – maintenance – creates positive cash flow. Based on the offered dynamic model we can define three directions of forming economic effects from implementation of innovations to an investment construction cycle from the perspective of an investor:

1) reduction of negative cash flow . investment cost of a project of construction (reconstruction);

2) growth of a positive cash flow from maintenance of a real estate facility;

3) reduction of duration of an investment construction cycle, which ensures growth of economic efficiency of the investor’s capital.

The defined three directions set up a field of scientific-theoretical research of approaches of assessment of a potential of implementation of innovations to an investment construction cycle. In the framework of scientific field of search it is necessary to address the following theoretical and methodological problems: classify innovative solutions, which can be integrated into an investment construction cycle at separate stages; define concrete results and economic effects of innovative solutions; develop economic model of assessment of the potential (desired effect) from implementation of innovations into an investment construction cycle. There was defined the approach to description of a regional ICC as an innovation system – a set of entities, which are engaged in innovative activities within an investment construction cycle. In the framework of discussion there were defined the following essential conclusions and provisions: investment construction cycle integrates innovative solutions in the framework of a built (reconstructed) facility; as a principle of discussion of innovation activities in a regional IBC there is an understanding of cross-effects of innovative activities at the ICC stages: effect of innovations implementation is shown up at the subsequent stages; effect from innovative activities in the framework of ICC should emerge at the level of investor, financial results of a project; three types of effects from implementation of innovations into an investment construction cycle from the perspective of investor were defined: reduction of investment cost of a construction project; growth of a positive cash flow from maintenance of a facility; reduction of duration of an investment construction cycle.

Asaul A.N. INVESTMENT AND CONSTRUCTION CYCLE AS A SUBJECT OF INNOVATION. International Journal Of Applied And Fundamental Research. – 2015. – № 1 –

URL: www.science-sd.com/460-24778 (04.03.2026).

PDF

PDF