About Us

Executive Editor:Publishing house "Academy of Natural History"

Editorial Board:

Asgarov S. (Azerbaijan), Alakbarov M. (Azerbaijan), Aliev Z. (Azerbaijan), Babayev N. (Uzbekistan), Chiladze G. (Georgia), Datskovsky I. (Israel), Garbuz I. (Moldova), Gleizer S. (Germany), Ershina A. (Kazakhstan), Kobzev D. (Switzerland), Kohl O. (Germany), Ktshanyan M. (Armenia), Lande D. (Ukraine), Ledvanov M. (Russia), Makats V. (Ukraine), Miletic L. (Serbia), Moskovkin V. (Ukraine), Murzagaliyeva A. (Kazakhstan), Novikov A. (Ukraine), Rahimov R. (Uzbekistan), Romanchuk A. (Ukraine), Shamshiev B. (Kyrgyzstan), Usheva M. (Bulgaria), Vasileva M. (Bulgar).

Economics

Under the influence of global crisis Kazakhstan, as many other countries, must review their budget policy. Reduction of tax income makes the government to search for new income sources. Regretfully, we can state that problem of avoiding taxes is still urgent and widely spread. This situation takes place at the background of low private income and property tax rates. Analysis of official statistic data shows us that about 50% of income among individuals, who live in Republic Kazakhstan, is not a subject of taxing [2]. As one of ways to solve the existing problem, the republic has selected transition towards total declaration of income and property. Critical changes in taxing legislation will affect many citizens, including three million people, who are defined by Ministry of labor as self-employed. A special attention of legislators is devoted home workers and labor immigrants who work outside of Kazakhstan and thus their income is not registered by the state.

The objective of transiting towards total declaration of income and property of citizens was set in 2010, according to Government Program of Republic Kazakhstan [4].

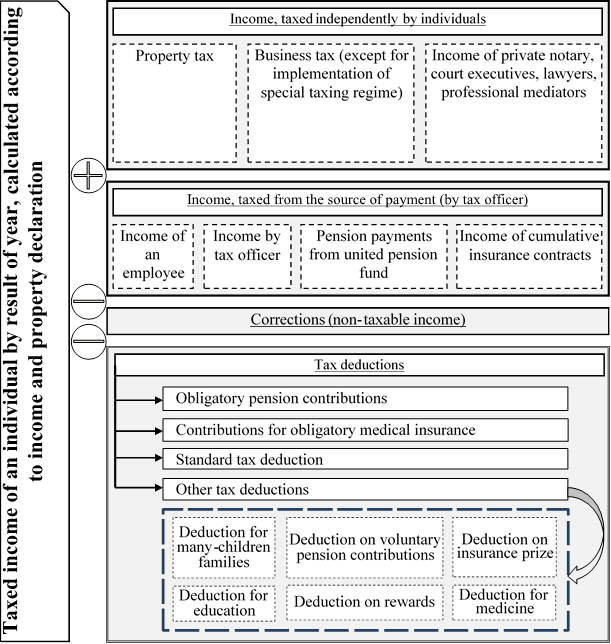

The new taxing code has a separate chapter, devoted to methodic of defining taxable income of an employee and methodic of calculating taxing object for individuals who determine value of income tax independently [1]. At the same time, as shown in picture 1 [3], calculation of taxing object for individual income tax for income, that is subject of taxing by individual independently, includes not only business and property income, but also income, taxed from the source of payment, such as income of individual employment contract. Non-taxable income and check-off (article 156 [1]) are excluded from total yearly income. In case a sum of taxed income has a negative value by the end of year, sum of taxing object is equaled to zero in order to calculate individual income tax. Thus, we can conclude that it is impossible to acknowledge losses for purposes of taxing individuals. However, a similar situation is presumed by legislation for legal bodies and businessmen and implies possibility to transit losses to future periods for reduction of tax obligations.

Picture 1 - schematic of calculating taxing object for individual income tax according to income, subjective to individual taxing [3]

As part of the taxation system modernization in the Republic of Kazakhstan has not only expanded the circle of persons who are obliged to provide a declaration, but, and developed an additional form of declaration for more coverage of the objects of taxation. There are three forms of tax returns for individuals being introduced. The first form of reporting is information about the assets and liabilities of an individual. The second form is for reporting the disclosure of annual information on income and property, the so-called regular report of an individual. Regular declaration may be presented in full or in summary form, without the application. Summary declarations are provided be people who have received income taxed at the source of payment. The third form of tax report is provided for labor immigrants who are domestic workers.

On particular note there is the fact that the calculation of the income tax amount to be paid directly to the declaration of income and assets that require special training of the applicant. If we consider the estimated amount of income tax in terms of methodology, the tax rate has not changed and is 10%, but section of tax deductions has undergone a great change.

In general, legislators have provided an increase in the amount of deductions, the task of which is more evenly distribute the tax burden between different categories of taxpayers, and support the socially vulnerable strata of society. More detailed analysis shows, that out of the three new deductions truly social orientations have only a deduction for families with many children and a deduction for training. Both deductions have limitations, for example, many children are recognized as family with four or more children, and the maximum for the year, you can reduce your taxable income by 24 minimum wages. To illustrate the benefits of the size it can be said, that its annual value is approximately one and a half thousand dollars, while the cost of preparing a child for school about 290 thousand dollars. Taxpayers who have fewer children are not eligible for the tax reduction obligation. Undoubtedly, such a restriction negates the very idea of ??social orientation residue.

With regard to the deduction for tuition, its size is limited to ten times the minimum wage per year, which is $ 650. In general, deduction for payment of educational services expenditures are partially new, as earlier, similar payments of legal entities in respect of their employees treated as income, not taxable. In addition, non-taxable payment of training for individuals who are not in labor relations provided the fixed intention of future employment. In this context, innovation is only a deduction in terms of educational services, paid by the taxpayer on their own (without reference to the activities of the employer), and was not to the declarant and the persons who are dependent on him. Table 1 shows a comparison of the size of the deduction in the current, and as amended. The analysis shows, that the benefit is extended itself in its action (added the ability to receive a deduction on children), but from the training costs are excluded travel and accommodation costs, which reduces the possibility of reducing tax liability. The set limit will not allow using net of all actual costs for educational services. More justly allow reducing tax liability by eliminating all the training costs for both of the taxpayer and his children.

Table 1 - Comparison of the taxation mechanism for training costs before and after the change in tax legislation of RK

|

Characteristics |

Revision of the Tax Code, before the introduction of universal declaration |

Revision of the Tax Code, after the introduction of universal declaration |

|

The right to reduce the taxable income |

Only the cost of individual training , for which a legal person is the employer, who pays for the cost of training |

Training costs, both the taxpayer and the benefit of children under the age of 21 years. |

|

The requirement for coherence with the current teaching profession |

The taxpayer has the right to reduce the taxable income only if the training is related to his current profession |

There is no requirement for coherence with current professional activities |

|

Structure of training costs |

1. Expenditure on training, including extracurricular activities; 2. The cost of travel; 3. Expenses for accommodation within the rules.

|

Only the cost of training services |

|

Presence of restrictions |

No restrictions |

The limit value for the year is 10 times the minimum wage |

In addition to the above, the legislation established aggregate limit for all deductions, excluding pension contributions and health insurance, which also makes it possible to deduct taxes, almost without taking into account the income differentiation. Establishing a limit on the amount of social deductions nullifies the idea of easing the tax burden for socially disadvantaged sectors of society.

Drawing attention to the social aspects of the impending tax reform in Kazakhstan, we note that it is based on the contradiction of public and private interests, as the government, on the one hand, seeks to broaden the tax base in order to more filling budget and at the same time simplifying tax administration procedures. On the other hand, taxpayers have different levels of income and objectively differing costs. In such circumstances, simple principles of calculation of tax liability do not allow to distribute the tax burden. It can become unbearable for certain categories of citizens. Against this background, there is a confrontation of interests: the state seeks to increase tax collection and taxpayers while seeking to evade them. Estimated change of the mechanism for calculating and collecting the tax on personal income affects the interests of all without exception, the layers of the economically active population, being thus one of the most important channels of formation of a profitable part of the budget system of the state. Using the income tax, the government is committed to implementing its major socio-economic goals: sustainable economic growth, full employment, to ensure a certain minimum level of income, creating a system of social protection of citizens, the redistribution of income and wealth.

Analysis of the new concept of the personal income tax in the Republic of Kazakhstan has shown that the system has become more complex and takes into account more factors affecting the collection of income tax. All innovations are aimed at the creation of special conditions to encourage taxpayers to self-disclosure of income, which has not previously been subjected to strict tax control. Thus, it is planned to increase and stabilize the future tax revenue, and thus not to increase income tax rate. Social aspects of the tax reform require careful study.

2. The official website of the International "Kazinform" News Agency [Online resource].

3. L.A. Popp, N.S. Kaftunkina. Modernization of the tax declaration of incomes within the financial initiatives of the strategic program - "100 concrete steps"// Kaz EC habarshysy. Economy. Number 6 (78), 2016 - Almaty KazEU. T.Ryskulova

4. The decision of the Government of the Republic of Kazakhstan from September 30, 2005 N 969. About the program "Main directions of economic policy and institutional measures to reduce the size of the shadow economy in the Republic of Kazakhstan for 2005-2010" [Online resource]. - 2005

Popp L. SOCIAL ASPECTS OF TRANSITING TO TOTAL DECLARATION OF PEOPLE’S INCOME IN REPUBLIC KAZAKHSTAN. International Journal Of Applied And Fundamental Research. – 2016. – № 5 –

URL: www.science-sd.com/467-25098 (28.02.2026).

PDF

PDF